BUYER'S RESOURCE »

Almost everyone knows by now that the interest rates have steadily crept up over the past few months. Although they are not directly related, knowing that there is a plan for more Fed rate increases, we would expect to continue to see an increase in mortgage interest rates.

Many buyers and sellers have opted out of the real estate game at the moment due to the increased interest rates, which have impacted both buying and selling. In the real estate world with current market conditions, there has been a lot of talk about loan programs with buydowns (also known as temporary buydowns) and how they can help both buyers and sellers to reach their goals.

You may be one of the people who has been around long enough to know that buydowns aren’t new, or you may be the opposite wondering what a buydown is. The general explanation is that buydowns allow a buyer to purchase a home by paying a lower rate than the current rate for a set period of time.

To explain this in more detail, you may have heard terms like 3-2-1 Buydown, 2-1 Buydown, and 1-0 Buydown. The first number in the buydown is the number of years that you can get a lower rate. Let me explain further. First, you must qualify at the current rate. I will use an example; let’s say you will be using a 2-1 Buydown. Since the first number is a 2, you will get a lower interest rate for 2 years. To use numbers, let’s say the current interest rate is 7%. For your 2-1 Buydown, you would have a rate of 5% for the first year, 6% for the second year, and 7% after those 2 years are up. The hope is that in that 2-year time period the interest rate will go down, and you can refinance at a lower rate, so you don’t have to pay that 7% rate.

The way this usually works is that the seller pays for this buydown with seller concessions. With a 2-1 Buydown, the lender sets up an escrow account, and for the first 2 years of your mortgage, you are getting a discounted rate. The seller concessions that have been placed in escrow are paying for the difference in your rate each year.

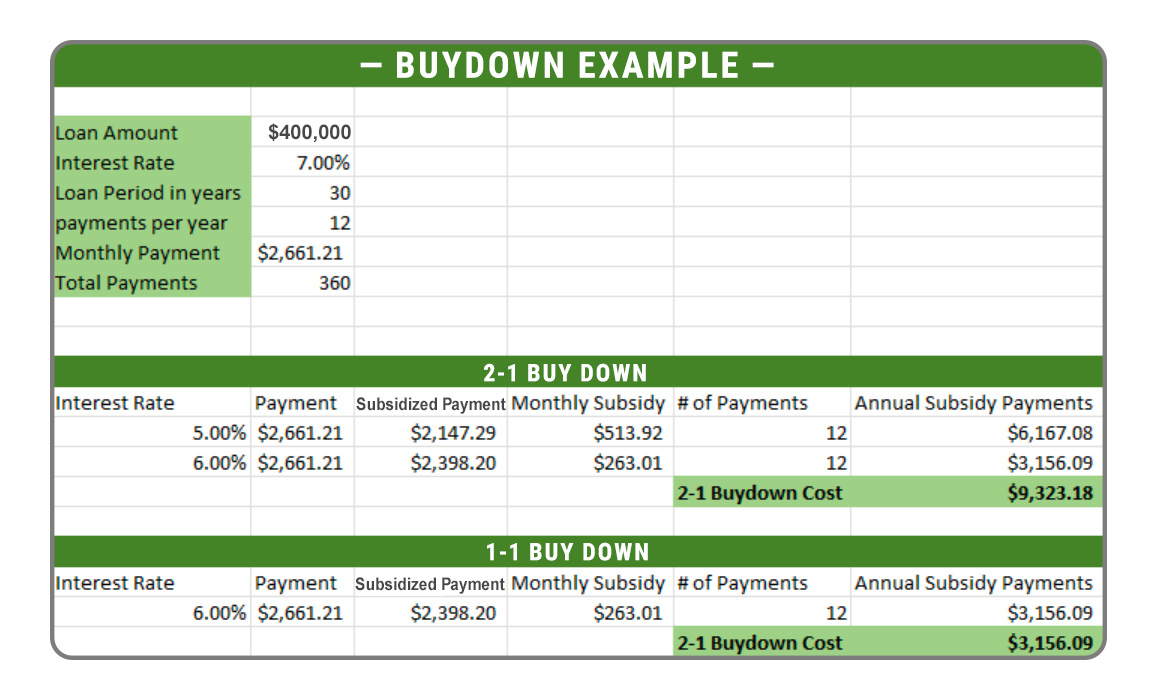

Once a buyer knows the market rate and their monthly payment, it is easy to calculate the cost of their buydown. To continue using our 2-1 Buydown example to calculate the total cost of your buydown, first take the difference between your monthly payment at the market rate and the 2% discounted rate. Then multiply by 12 to get your annual savings. Then for the second year, you take the difference between your monthly rate at the market rate and the 1% discounted rate and multiply by 12. To get your total savings, you would add both annual savings amounts together. If you are a buyer and want to use a 2-1 Buydown program, that is the amount that you would want to ask for in seller concessions.

Let’s look at some actual examples that include a loan amount, so you can see how these buydowns work with real numbers and also so you can better understand the explanation above.

* Buydown Example Courtesy of Mountain State Financial Group, LLC

These types of buydown programs can be used on conventional, VA and FHA loans, but they cannot be used with CHFA loans. These payment programs are only for owner occupied and second home purchases.

Buydowns are a great option. They are a creative way for sellers to potentially get their homes sold quicker by offering options for buyers to get a lower interest rate. For buyers, they are a way to get a lower monthly payment for a set period of time. Although these buydown loan programs are a tool that we have to help sellers and buyers achieve their goals with today’s real estate market conditions, they may not always work for every transaction or scenario.

At TK Homes, although we are not lenders, we understand what buydowns are, and we can help you to find a trusted lender to go over your individual situation with you. We also recognize that there are some things to be cautious about when considering using these buydown programs. Our blog next week will go into more depth about what to keep in mind before using any buydown program. As always, please contact us at TK Homes if you would like to buy, sell, or invest in real estate. We would be happy to help!

A special thanks to Bob Hoff, Zach Zink and Seth Angell at the Mountain State Financial Group, Kurt McGary with Universal Lending Home Loans, Nicole Rueth with One Trust Home Loans, and Edward Charleson with Fairway Independent Mortgage Corporation for providing us with information on buydown programs.

~ Written by TK Homes REALTOR®, Mary Smith

**TK Homes and its team members are not licensed financial advisors or mortgage professionals. This is not financial advice; all specific financial questions should be asked to mortgage professionals and/or financial advisors.