BUYER'S RESOURCE »

Owning a townhome or condo in a community with a homeowners association (HOA) can come with many benefits, especially for first-time homeowners, investors, or homeowners looking for extra value or convenience. These types of homes can offer very positive and fulfilling experiences, but as with many things, there are pitfalls that can turn this kind of property ownership into a nightmare!

We would like to offer some guidance to prospective buyers to help ensure buying a condo or townhome is a smart, successful investment with a rewarding outcome. For this article, we are turning to our in-house graphic designer for his recent experience living in a community with a homeowners association and serving on a that homeowners association the past few years in the high demand area of Old Town Arvada.

Here are a few of the things that should be looked at when buying a property that is part of an HOA.

1. Operating Budget & Reserve Budget

2. Special Assessments

3. Reserve Study

4. Regular Dues

5. Differed Maintenance

6. Percentage of Renters vs. Owners

7. Covenants & Declarations

8. Attend a Meeting

Let’s get started.

Operating Budget & Reserve Budget

What are they? «« Operating budget is the actual money that the HOA/management company has to pay to maintain the community on a monthly basis. The reserve budget is the association’s money left over after paying the required operating expenses. These reserves can be used to cover unexpected & non-recurring expenses, such as an insurance claim for roof replacement after a major storm. Different resources have different estimates for what a HOA should have in reserves. Ideally, or in a perfect world, the reserve should have 100% of the operating budget, but the reality is most HOA reserves have somewhere between 40%-70%.

Why does it matter? «« Any HOA reserve account below 40% should be a cause for concern. It could be a sign of financial issues and indicate the potential for problems, especially if major issues occur outside of normal operating expenses. In many cases, an HOA with below 40% will have to issue a special assessment in the future or at the minimum, raise regular HOA dues to offset this lower reserve budget.

Special Assessments

What are they? «« Special assessments are charges levied on owners to pay a portion of major expenses for projects that are not included in the regular operating budget. Usually, they are major items, like construction, renovation, or large repairs, such as roof replacement due to a major storm.

Why does it matter? «« Special assessments are assigned to the unit owner and are their responsibility. They must be paid off or passed on to the buyer when the unit is sold. If you own a unit in the HOA with a special assessment, there is no way out of paying for this special assessment. Often, special assessments can be for a few hundred dollars, a few thousand dollars, or even several 10’s of thousands of dollars.

Also, they can be an indicator that the condo association has repairs that their budget cannot cover, or they have some amount of debt. The assessments can be representative of repairs or construction they might not be able to cover. This may indicate need for further research as to the cause of assessment and if the work/repairs have been completed or contracted and scheduled.

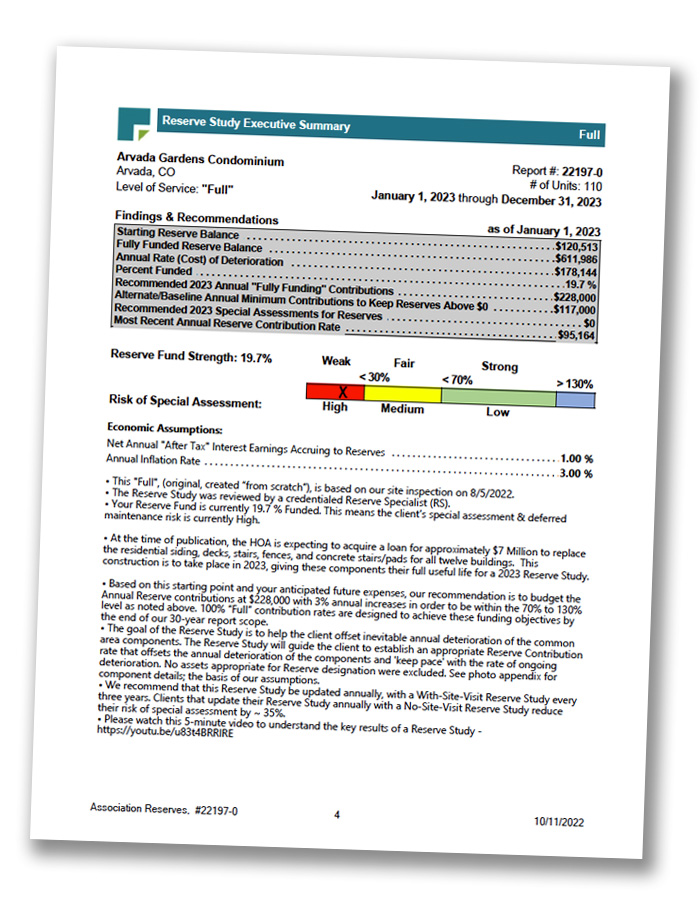

Reserve Study

What is it? «« A Reserve study is a study completed by a third party. The third party will create a report that looks at the community’s physical assets and components and relates the value, condition, life span, and remaining usability of these elements to the actual budget. Then, the study proposes an estimate of what the budget should be based on their conclusions.

Why does it matter? «« A reserve study is the first step in determining the financial health of a community. By reviewing a reserve study, you will be able to determine how well the community has been maintained and if there are any big expenses coming up that the HOA might not be prepared for. Also, since the condition of the community is constantly changing, reserve studies should be performed every 3-5 years. If there is no reserve study on file or the last study was completed more than 3-5 years ago, it may be an indication that they do not have a very good handle on budgeting, or they may have some financial struggles looming.

Regular Dues

What is it? «« Regular dues are a recurring assessment that fund the majority of the HOA’s operating budget. These are attached to the unit ownership and passed from owner to owner. They are not attached to the value of the unit, but the service, management, and maintenance of the property as a whole. In townhomes and condos, it’s most common to see these regular dues paid monthly. However, some communities might require dues to be paid annually, bi-annually or quarterly.

Why does it matter? «« Although low regular dues can be very appealing because they can mean an overall lower monthly cost to the buyer—beware. If the regular dues are abnormally low, it can indicate that the HOA’s operating budget and/or reserve budget may be underfunded, or the budget may have adequately funding at the time of purchase, but the low dues could be an indication of looming deferred maintenance issues. This can happen when the association doesn’t take care of big-ticket items in order to keep owner’s monthly cost down. It is also important to know that these regular dues can be adjusted at any time by the HOA, so make sure you’re prepared to pay higher regular dues in the future. In order to determine if the regular dues may increase, you should study the most recent operating budget to see how much money is left after paying these recurring expenses and how much is being placed into the reserve budget each month. If there isn’t a lot left or it’s negative, it’s only a matter of time until higher regular dues are coming and potentially even special assessments.

Differed Maintenance

What is it? «« Differed maintenance is long-term maintenance that has been neglected and not done. It usually becomes more expensive and more problematic the longer it remains unattended too. Examples of differed maintenance are roofs, siding, patios, exterior stairs, pools, etc.

Why does it matter? «« When you have an HOA that is responsible for the maintenance and upkeep of big-ticket items like roofs or siding, costs can add up quickly if issues are ignored. Eventually, the differed maintenance will become too big to ignore. If there are not enough reserves, the HOA will have no choice but to pass the expense on to the owners in the community through special assessments. When we are talking about replacing the roofs on multiple buildings, we are usually dealing with very large amounts of money, possibly in the multimillions.

Percentage of Renters vs. Owners

What is it? «« This is the number of units that are owner-occupied vs. units that are tenant occupied.

Why does it matter? «« There are certain factors that can be affected in the community depending on the number of owner-occupied units vs. tenant occupied, including loan programs and number of active board members and association participants.

Covenants & Declarations

What is it? «« These are the governing documents that are the framework for how the HOA operates. They are legal documents that the HOA residents and management company must conform too.

Why does it matter? «« Although these documents are dry, boring and can be somewhat difficult to understand, these are the resources that will dictate the way that the HOA budgets and how special assessments are presented and approved. These documents are a window into how the HOA processes are implemented. It is also important to look at when they were last modified. If they have not been updated in recent years, they may not be compliant with current laws.

Attend a Meeting

What is it? «« Most HOA’s have monthly or quarterly meetings. They are generally public and often online. If possible, we recommend attending one prior to purchasing your condo. If you cannot personally attend a meeting, be sure to review the most recent meeting minutes, which is a document that outlines what was discussed at the meeting.

Why does it matter? «« From my experience, many residences don’t attend HOA meetings until long after becoming a resident. Often, they finally feel motivated to participate because of some type of grievance, concern, or issue. Attending a meeting before purchasing will be a window into the relationship between the homeowners, HOA board and management company. It will also give a perspective on things going on in the community that may not be apparent from what you can see in the property or the provided documentation. In fact, it is often these meetings where you will first learn about potential differed maintenance or special assessments being discussed.

Owning a home in a multi-unit property can be a very rewarding experience. These properties are often in very desirable locations and can provide a comfortable easy to maintain lifestyle. Although this article focused on a lot of scary scenarios, this article is intended to help buyers achieve a positive outcome when buying a new townhome or condo. Unfortunately, buyers often lock themselves into a bad situation because they don’t know or understand the situation they are buying into. With the tips outlined in this article, along with some help from a TK Homes agent, you can identify and make an educated decision when purchasing a new townhome or condo.

~ Written by TK Homes Art Director, Mike Butler