News & Events »

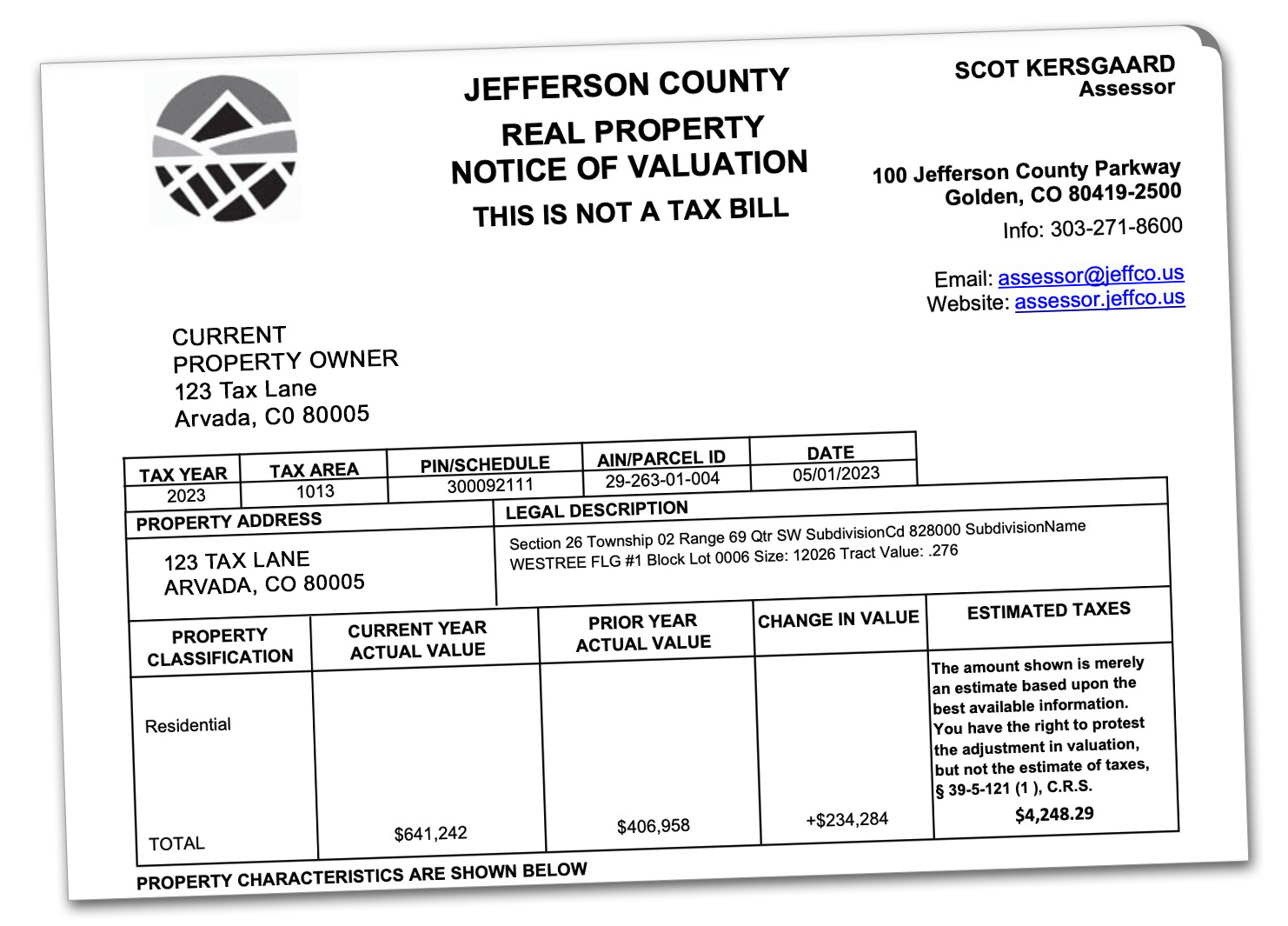

If you are a homeowner in Colorado, your newest county assessed property value has surely been a recent point of conversation. Because of the 25% to 50% increase in valuation, it likely has not been a positive conversation. At TK Homes, we want to make sure that our clients are being educated and taken care of, regardless of if they are buying or selling a home or already own a home. So, we felt it was important to share a little information on why assessed values are such a hot topic this year.

Why is this happening?

First, let’s talk about why this is even a conversation. There were two main events that triggered this year’s major increases. First, Colorado voted on removing the Gallagher Amendment back in 2020. The Gallaher Amendment was originally in place to prevent property taxes from rising too quickly. Second, Colorado saw an unprecedented amount of appreciation in 2021 and the first half of 2022. These two items unfolding at the same time created the opportunity for property taxes to rise on average 25% to 50% in a single year.

Is there anything we can do about it?

Unfortunately, there’s no way for us to go back in time and change how we voted in 2020 to keep the Gallagher Amendment in place. However, this does not mean that there’s nothing we’re able to do about it today.

The first action you can take is to appeal your home’s new valuation. The exact process of how you can appeal is dependent on your specific county; for example, in Jefferson County, you can appeal via mail or online HERE. When appealing the valuation, you will want to make sure you have comps for your neighborhood that have sold in or prior to June of 2022. This is because the valuation is based on your home’s value in June of 2022. This is important to remember because home values in June of 2022 were near their all-time high values. It was in July through the rest of the year that we saw a cool off, and values slip downward. The reason you need older comps for the assessed value is that Colorado’s property taxes are paid in arrears, so these property taxes are based on that year’s valuation. Once you have your comps, follow the appeal process to submit your appeal. Don’t put this off because appeals must be submitted on or before June 8th.

The next thing you can do to help lower or keep this type of major property tax jump from happening again is to watch for a new statute to vote on in November’s ballot. Governor Polis has already announced a plan that will help reduce property tax amounts and put in place a plan to help avoid major increases again in the future. So, be sure to watch for this on your ballot and help vote it into law.

Is there any way TK Homes can help?

We understand that you’re not a real estate expert, but luckily you know people that are. TK Homes is happy to look at your home’s assessed value and review comps to determine if an appeal makes sense for your situation. In the event that it does, we’ll provide you with three great comps you can include with your appeal. Simply fill out the short form below, and we’ll provide you with the best comps for your appeal or the peace of mind that your valuation is realistic. Don’t forget to share this article with family and friends who might also find this information useful!

~ Written by CEO/REALTOR® Trevor Kohlhepp

*By requesting comps from TK Homes, you are giving permission for your email address to be added to our monthly newsletter.